Blog > A guide to your first payslip

A guide to your first payslip

September 6th, 2022

We all get thrilled at the prospect of earning our first salary, but we often forget to consider the technicalities mentioned in the fine print of our offer letters. At least until we are presented with our first pay cheque and it’s too late to rethink our salary structure.

It’s safe to say that as we enter the next phase of adulting and start our careers, we must take a good look at the fine print of our offer letter and salary slip.

So read along so that you can be thoroughly prepared and give a resounding “Yes!” when you inevitably land your first job.

Did you know that it is compulsory for employers to provide a salary slip to their employees?

Under the Minimum wage Act (1948) - “A wage slip in Form XI shall be issued by every employer to every person employed by him at least a day prior to the disbursement of wages.”

But why is it important for you to receive your salary slip, you ask? There are a couple of reasons.

Firstly, your salary slip acts as a legal proof of wage for you. It also provides a legal proof of association with the employer or the firm you work for. You require proof of wages especially when you’re applying for loans of any kind.

Secondly, your payslip also contains a complete breakdown of your salary, including all the deductions made on it. It can help you evaluate the amount you have to pay in taxes. Furthermore, it will help you estimate your tax refunds if any.

And lastly, your old salary slips can be used to negotiate a better offer with any new organisation you’re planning on working with.

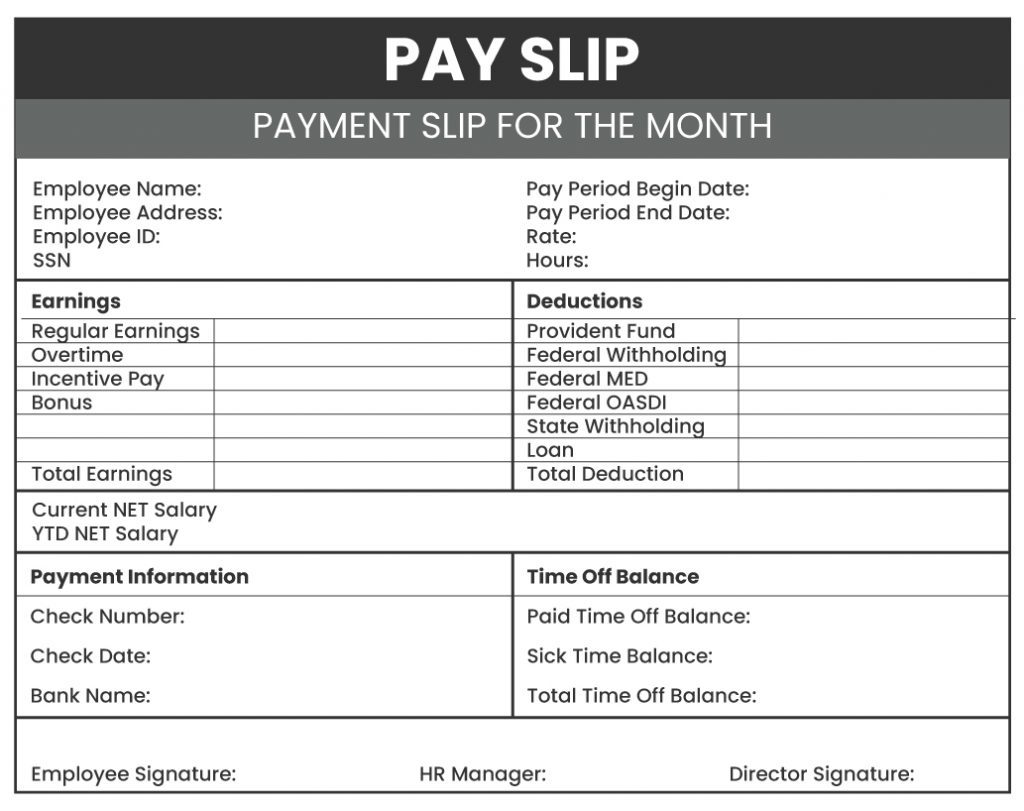

What your payslip looks like

Your salary slip, as you can see, comprises 2 main sections - Earnings and Deductions.

We will look into each of these in detail, but before we go any further however, there is one term you should be familiar with.

| CTC stands for cost-to-company. Your CTC won’t be mentioned on your payslip, but you will hear the word thrown around a lot during your salary negotiation. It is important to know that your CTC is not the same as what you will get in-hand. |

All these components make for your total Earnings on the payslip.

Regular or Basic Earnings

As the name suggests this component is the base of your salary. It should make up for around 35-50% of your total earnings. It is the fully taxable component of your earnings, and is subject to income taxes. Your employers will usually keep your Basic salary to a minimum, so that you don’t end up overpaying your taxes.

Overtime

You probably already know what overtime stands for. It’s the compensation an employee gets for working past the determined work hours. Most companies have fixed overtime rates on a per hour basis. Make sure you are aware of what your overtime pay will amount to before you put in all those extra hours!

Dearness Allowance

DA is given to match the high costs of living. It is fully taxable as well and makes part of your take-home pay. DA varies in different places, depending on how high the inflation is over there.

House Rent Allowance

HRA is meant to compensate for your rent, only if you're renting a house at the time. It typically comprises 50% of your pay in large metropolitan cities where rent is high, whereas 40% is more typical in smaller cities. The maximum you can claim is based on the extent of your actual rent however, since it is an reimbursement.

Medical Allowance

A lot of established companies provide their employees with Medical Insurance. You can claim this allowance by supplying the company with proof of a medical treatment needed during your employment.

Conveyance Allowance

Also known as Travel allowance, this component makes up for all your travel expenses, between your home and office. It forms a part of your take-home salary and is not taxable until a certain limit.

Variable Component

Most jobs split a portion of your Salary into Fixed and Variable. The variable is given as an incentive or bonus to motivate their employees to deliver consistent good work. It is also based on your performance.

Other Allowances

Any additional allowances given to employees is mentioned here. For example, some companies offer meal coupons that get added here.

Like the Earnings side, the Deductions side is also made up of a few components:

- Provident Fund (PF)

PF is the mandatory contribution an employer or employee makes towards the employee’s pension. By law an employer must deduct 12% of the basic salary every month. The employer must then submit a similar amount towards the employee’s PF. Your PF is an investment and gains interest every year and is meant for post retirement purposes. It is also completely exempt from further taxation.

- Gratuity

Gratuity is a form of thanks an employer gives their employees. It is deducted from the basic salary and added to the Gratuity fund. Employees can claim this amount, however they need to complete a tenure of 5 years to be eligible.

- Professional Tax

Most states in India tax this amount from self-employed or salaried employees and it is collected by the Government of India. It is an allowance paid towards the State Government to practice your profession. It differs from state to state, however the maximum amount payable is Rs.2500/- per annum.

- Income Tax or TDS

TDS stands for Tax Deducted at Source. The income tax is the final deduction made to your Salary after considering all the exemptions that apply to the respective Tax Slabs individuals fall under (e.g., if your annual income is less than Rs. 2.5 lakhs, then you won’t be charged an income tax. If it is between Rs. 2.5 lakhs and Rs. 5 lakhs, you will be charged 5%).

You can reduce the amount paid as income tax by declaring your investments and tax saving portfolios like various insurance policies, provident fund or any loans taken.

That makes up the total of the deductions made on your Salary.

We’ve covered all the important aspects that you should know about, but to give you a clearer picture, let’s take a look at the additional components as well.

Under the Earnings and Deductions, your Net Pay after all the necessary calculations will be displayed, along with the Authorised Signatory and Company Stamp.

Understand that there your salary slip format will differ slightly according to the organisation you work for, however the main components should remain the same.

We hope this blog helps you prepare you for the Job World and helps you negotiate better for your first salary.

If you have any queries or any notes to add, leave them in the comments below.

Add a Comment